Norway owns a part of Putin's propaganda and censorship machine

The value of the shares owned by the Norwegian Oil Fund has dwindled to less than 5 percent of their former level. But the Norwegians still own shares in 52 Russian companies, among them several leading tech and communications companies.

The Norwegian Government Pension Fund Global, also known as the Oil Fund, had a good year. The fund that is managed by the Norwegian Central Bank on behalf of the country’s Ministry of Finance in 2023 returned 16,1 percent, equivalent to 2,222 billion kroner (€195 billion), CEO Nicolai Tangen of Norges Bank Investment Management announced this week.

As of 31st of December 2023, the fund had a value of 15,765 billion kroner (€1,383 billion), of which 70,9 percent was invested in equities. The Oil Fund now holds about 1,5% of all of the world’s listed companies. It is the world’s largest single sovereign wealth fund.

“Despite high inflation and geopolitical turmoil, the equity market in 2023 was very strong, compared to a weak year in 2022,” Tangen said.

To a great extent, that turmoil is triggered by Russia and its war against Ukraine. Still, the Norwegian government fund continues to own a significant part of Russia’s leading companies. According to the list of holdings, there are 52 Russian companies in the portfolio.

The most valuable holdings are in the field of oil and gas, and especially the companies Gazprom and Lukoil, worth respectively 232 million NOK and 288 million NOK. The Fund also owns a 0,72 percent stake in Sberbank that has a value of 326 million NOK.

The Fund also owns more than one percent of companies such as Phosagro, Segezha Group, Rosseti, Bank St Petersburg PJSC and more. On the list are also companies sanctioned by the USA and EU, such as Sberbank and diamond producer Alrosa.

In addition, the Norwegians owns shares in several of the companies actively exploited by the Kremlin to censor and streamline public opinion.

The Oil Fund owns 0.47 percent of VK Holding, the technology company that operates social media vKontakte (VK). The social media now has more than 650 million accounts and is one of the most popular websites in Russia. In late 2021, Russian state-owned bank Gazprombank and insurance company Sogar acquired 57,3 percent of the VK shares and consequently secured full control over the company.

Few years earlier, founder and CEO Pavel Durov had been forced out of the company, reportedly following his refusal to hand over personal details of users to the FSB and his refusal to shut down a VK group dedicated to anti-corruption activist Aleksei Navalny.

Over the last few years, the VK has blocked hundreds of accounts operated by independent journalists, civil society activists and other Kremlin critics. In 2022, the company blocked the pages of Aleksei Navalny, Ilya Yashin, as well Mikhail Khodorkovsky and media companies Meduza, MediaZona, Dozhd, Echo Moscow, Current Time and others.

On the list of ownership is also Yandex, the Russian tech company that is most known for its internet search engine. The Oil Fund owns 0,96 percent of company that is considered Russia’s biggest technology company.

One of the founders of Yandex was Arkady Volozh, a man who in 2017 showed Vladimir Putin around in the fancy downtown Moscow offices, but who five years later emigrated to Israel following war and Kremlin crackdown.

According to Meduza, the tech company was in 2023 taken over by a group of Kremlin-loyal oligarchs. It is now controlled by Vladimir Potanin’s Interros, Aleksei Mordashov’s Severstal, Vagit Alekperov’s Lukoil and bank VTB.

The Norwegian Oil Fund also owns minor shares in telecommunications companies MTS and Rostelecom.

The latter is Russia’s biggest state telecom company. Recently, the company has been busy developing an electronic distant voting system that is to be applied in the upcoming Russian presidential elections, company CEO Mikhail Oseevsky told Putin in a meeting in June 2023.

The most valuable Russian holding of the Norwegian Fund is Sberbank. The Norwegians own 0,72 percent of the company that is Russia’s biggest bank and one of the country’s major technology developers.

Sberbank is actively working in a wide field of tech development, including in artificial intelligence. When Putin visited the “Rossiya” exhibition on the 1st of February this year, he had a stop at Sberbank’s stand.

In his meeting with Sberbank CEO German Gref in March 2023, Putin revealed that he is in “constant contact” with the Sberbank leader.

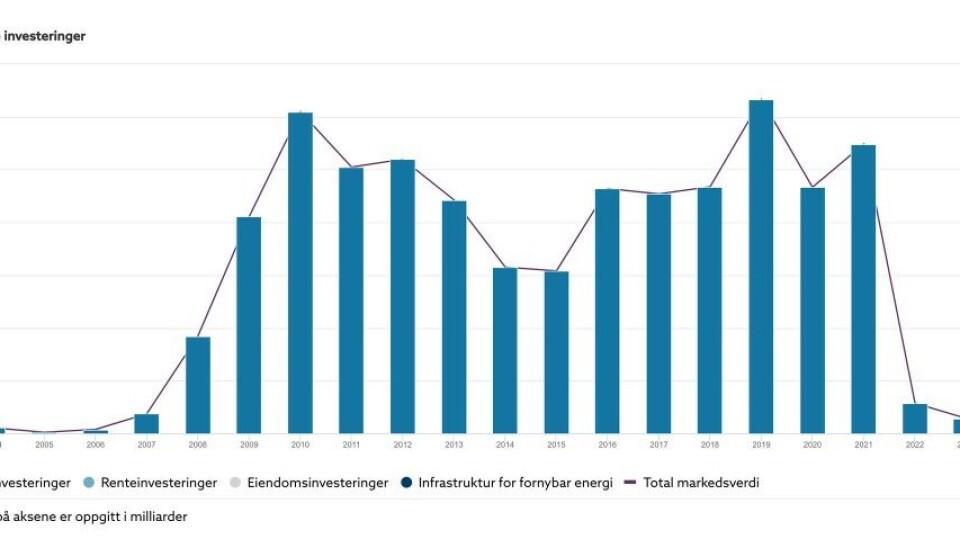

The 52 Russian holdings total only a tiny share of the Norwegian Oil Fund. Whereas the assets had a value of more than 31 billion NOK (€2,72 billion) in 2019, they were in 2023 worth less than 1,5 billion NOK (€131 million).

But the symbolic effect and moral aspect of holding stakes in Russia’s war economy and the system of repression, propaganda and censorship is significant.

In a comment to the Barents Observer, Communication Chief at the Norges Bank Investment Management Line Aaltvedt says that the investments in Russia are currently frozen, but that the goal of the Norwegian government is to sell all the holdings.