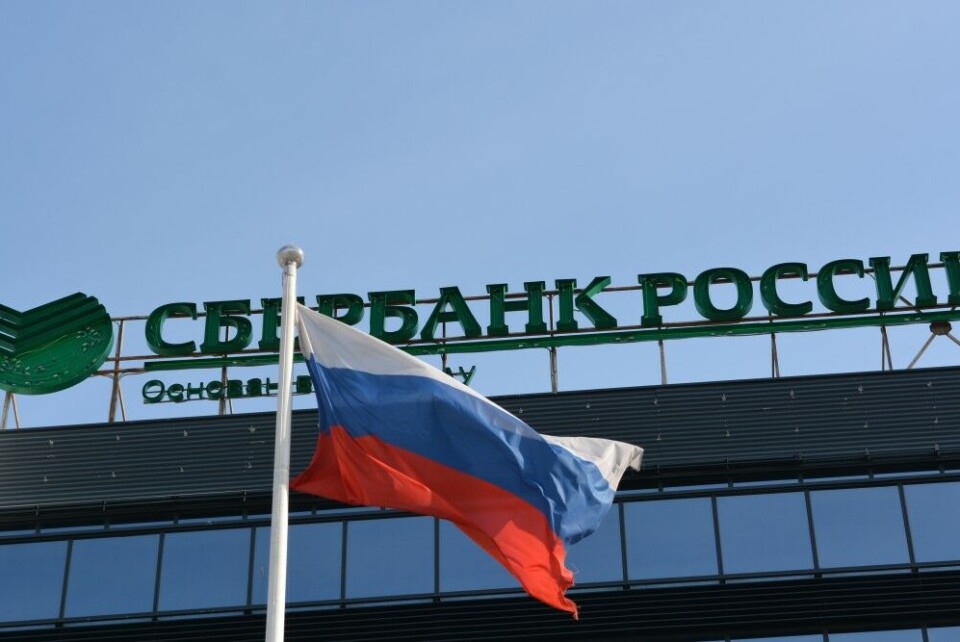

Russia hikes interest rates to 20%

Russia hiked interest rates to 20% on Monday in a dramatic attempt to stabilize the country’s financial markets.

The decision was taken in an emergency meeting Monday morning before trading started, but failed to stop the ruble from collapsing once markets opened for business.

The bank said that this would allow it to “support financial and price stability and protect citizens’ savings from depreciation.”

In frantic trading when markets opened on Monday the ruble collapsed by at least 20%, passing the 100-mark against the U.S. dollar. Banks and exchange outlets around the capital were charging much higher rates for hard currency.

Russia has been hit with unprecedented economic sanctions after it invaded Ukraine last week. The central bank’s western assets — up to 40% of its $630 billion international reserves — have been frozen, some banks have been kicked off the SWIFT financial communications network and access to international capital markets has been frozen.

The country is facing a run on banks, significant capital outflows, a currency crisis and surging inflation, and analysts say the looming economic crisis could be the worst since the fall of the Soviet Union.

Russia’s Finance Ministry also said it would mandate companies to sell at least 80% of their foreign currency earnings on the domestic market — a move that will force them to buy rubles, thus creating demand for the under-siege currency.

Russia’s exporters brought in close to $600 billion in 2021, meaning the forced sales could provide more than $1 billion to the market a day. Economists said the move was designed to replace the Central Bank’s typical role in stabilizing the currency, which was hit by the freezing of its assets held in the West.

The regulator also banned non-Russians from selling shares in companies listed on the Russian stock market and suspended equity trading until at least Monday afternoon.

This article first appeared in The Moscow Times and is republished in a sharing partnership with the Barents Observer.